The rental housing market in Europe

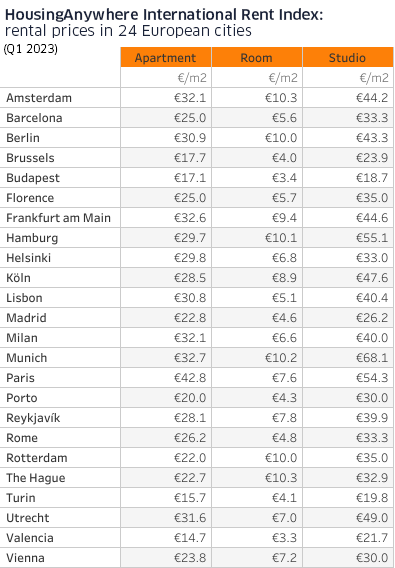

For the first time in six quarters, the International Rent Index published by HousingAnywhere (Europe’s largest international housing platform for students and young professionals with 30 million unique visitors per year and more than 160,000 rental properties) reveals that the rental price increase across all property types in the 24 European cities covered by the index slowed in the first quarter of 2023 compared to the previous quarter (from 14.3% to 11.9%), with the year-on-year increase also showing a slight slowdown.

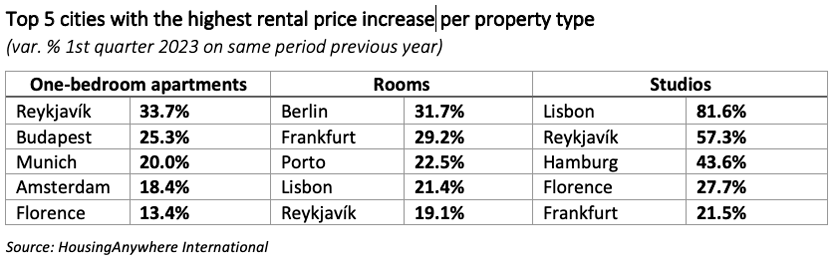

“Even before the pandemic, rental prices were too high for many people to live how they want and where they want,” says Djordy Seelmann, CEO of HousingAnywhere. “The current slowdown in rental price increases merely indicates a return to the pre-pandemic state, marked by a significant supply-demand imbalance. To tackle the European housing crisis, governments must address the structural undersupply with a balanced mix of incentives and restrictions. It’s time for them to act and enhance housing availability, affordability, and accessibility.” When considering YoY changes, an average 11.9% increase of rental prices across all types of properties still indicates much higher rental prices than what was registered a year ago. More specifically, the rental price of studios increased by 16.7%, rooms by 10.9% and apartments by 7.9%.

Demand continues to grow

However, the peak season of the year is still ahead of us. Faced with the onset of high season for tourism, supply of residential rental housing is at risk of being further reduced in this period, as some property owners may switch their properties from mid-to-long term rentals to short term accommodations for tourism purposes. With the new academic year starting in the fall and students and young professionals looking for a place to stay, an even greater imbalance between supply and demand may keep prices rising in the months to come. The Netherlands, Germany and Portugal are registering some of the highest YoY increases across all property types. For instance, when looking into one-bedroom apartments, Munich ranks third in terms of YoY increases (20%), followed by Amsterdam, which ranks fourth (18.4%). When focusing on rooms, the German cities of Berlin and Frankfurt lead the list of the highest YoY increases (31.7% and 29.2%), followed by Porto and Lisbon in Portugal with YoY increases of 22.5% and 21.4% respectively. Cities in Italy and Spain are also showing significant YoY increases in almost all property types. Florence is particularly noteworthy for showing the highest rental price increases in Italy (+13.4%) in all property types. But in Portugal too, both Porto and Lisbon are registering high QoQ increases across all property types.

Studios reach record prices in Lisbon

Rental prices for studios in Lisbon have increased by no less than 51.4% this quarter, making it the city with the highest QoQ increases for studio prices in the Rent Index. Dutch and German cities are also on the rise, with Rotterdam surpassing Amsterdam in terms of QoQ increases for studios with a rise of 10.5% and The Hague with a rise of no less than 31.6%. In Berlin studios have become 12.7% more expensive, while in Hamburg apartment prices have gone up by 11.1%. Florence is the Italian city registering the highest increases for all property types. Most notably, prices for studios in Florence have gone up by 13.5%. Overall, studios are the property type that shows both the highest QoQ and YoY increase. The decrease in supply for studios combined with increased demand from young professionals, are likely to be the primary drivers for the increase in price.

Rental yields in Italy

As for the Italian market, a survey by Idealista reveals that the home rental market offered a gross yield of 7.9% at the end of March 2023 compared to 7.4% at the end of 2022 and to the 4.3% of the 10-year BTP Italian government bond. Purchasing commercial premises in Italy for rental purposes (assuming a tenant can be found) offers a gross return of 12%, up from 11.7% a year ago. Offices offer a yield of 9.4% (up from 9.1% a year ago) and garages 7.2%, the same level as in March 2022.

Among the large markets, residential yields stand at 5.8% in Naples, 5.6% in Rome and 5.4% in Milan. Commercial premises offer the highest profitability in almost all provincial capitals, with the highest yield obtained in Milan (15.4%), ahead of Venice (15.1%) and Genoa (15%). In Milan, explains Francesca Zirnstein, CEO of Scenari Immobiliari, “rental demand is increasing, with rents up by 3.5% in the last 18 months. This should come as no surprise given that the city once again has more than 1.4 million inhabitants, including around 280,000 foreigners, along with a portion of the population that is changing constantly. Contributing to this continuous demographic transformation are the more than 185,000 domiciled but non-resident citizens whose housing requirements change continuously.”

May 2023