The European hotel sector attracts investors

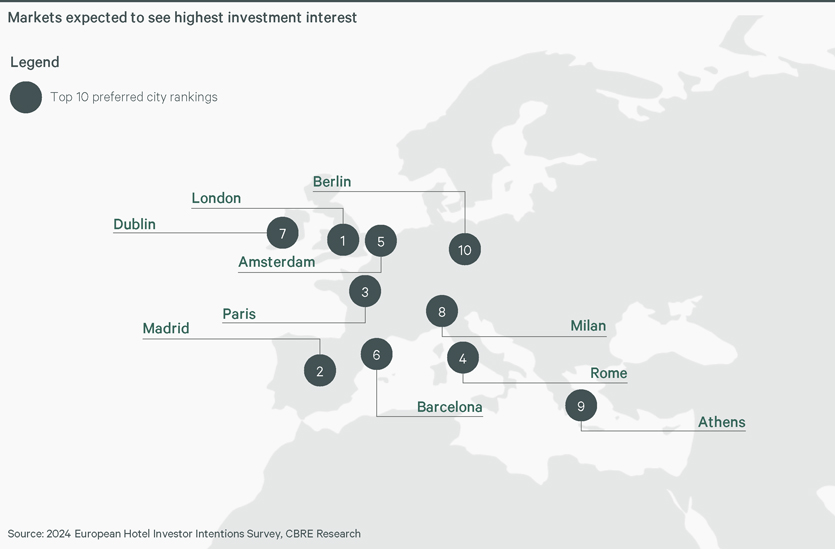

(June 2024) | The current growth in tourism is driving a surge in renovations of outdated buildings and new hotel construction. London remains the most desirable city for hotel investments and Madrid has overtaken Paris to claim second place, but Italy is also performing well with Rome ranked fourth and Milan eighth. More significantly, forecasts indicate that 90% of investors plan to maintain or increase their investments in 2024, with Italy ranking as the third most popular investment destination following Spain and the UK.

The hospitality industry is experiencing significant momentum and, as indicated by CBRE’s “2024 European Hotel Investor Intentions Survey”, the European hotel investment market is poised for growth through the current year. In the first quarter of 2024, Italy emerged as Europe’s second-largest hotel investment market with a total expenditure of €330 million, a 9% increase compared to the same period in 2023.

Italy, according to Deloitte Real Estate & Hospitality, has the potential to outperform the rest of Europe in terms of hotel revenue and ability to attract investors, particularly in the upscale segment. A report on 2023 reveals that Italian hotels generated €30.5 billion in turnover, securing the top spot in Europe ahead of the UK’s €27.7 billion and France’s €26.2 billion. Italy’s success is largely driven by higher room valuations and sales compared to other countries, along with its extensive hotel inventory, which comprises 31,806 establishments or 21% of all European hotels. This surpasses second-placed Germany’s 22,185 hotels and France’s 18,067. In 2019, Italy saw a peak in hotel investments at €2.8 billion. However, this figure sharply declined in 2020 due to the pandemic. Although there has since been a gradual recovery, investments have remained below pre-pandemic levels (€1.5 billion in 2023). Despite this, investor interest in Italy has remained robust into 2024, with 89% of investors focusing on the country. Notably, half of these investments target the luxury market, with 26% allocated to luxury accommodations and 21% to top luxury segments.

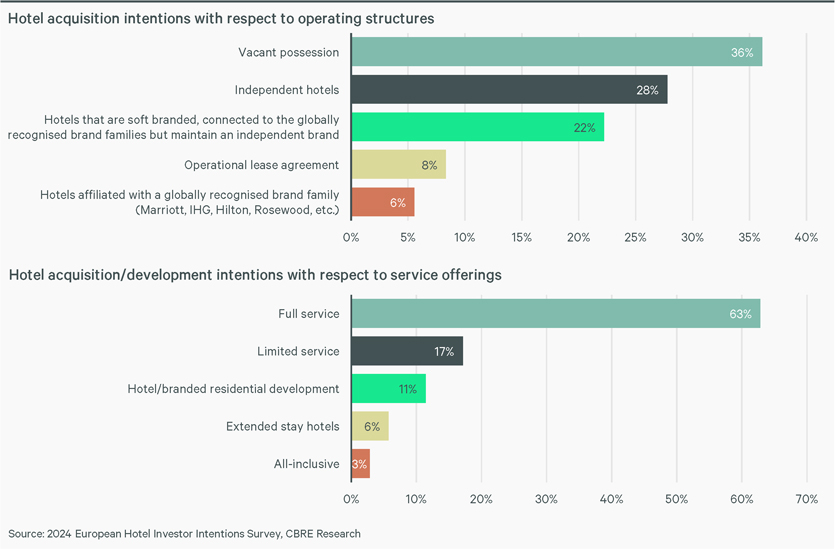

According to the CBRE survey, companies with less than US $5 billion in assets under management globally will be the most active, with more than half intending to boost their investment volumes in the sector. Conversely, only 10% of companies with over US $50 billion in assets globally plan to do the same. The upper upscale and luxury segments are considered the most attractive for investment, favoured by 51% and 45% of respondents, respectively. Both segments rebounded swiftly after the pandemic and outperformed the overall hotel market, buoyed by pent-up demand.

London retains the top spot in the city rankings, benefiting from strong long-term fundamentals and anticipated higher levels of spending by inbound tourists. Madrid has overtaken Paris to claim the second position amongst the most popular European cities for hotel investments and is proving increasingly attractive to global capital, with particular interest from Latin America. Among Italian cities, Rome and Milan both ranked in the top ten, positioned fourth and eighth, respectively. Athens also featured in the top ten cities. The city benefited from a surge in hotel operating performance of over 30% year-on-year in 2023, and the continued strength of Athens and several of Greece’s resort markets now offers investors a meaningful alternative avenue for portfolio growth and diversification.

Italy continues to be an appealing market for investors, ranking as the third most desirable destination in Europe for hotel investments. Despite a decline in trading volumes, hotels accounted for over 20% of the total real estate volume in Italy last year.

“Hotels have always proven a great inflation hedge,” explains Kenneth Hatton, Head of Hotels Europe at CBRE. “Following the year-end forecasts of rate cuts, investors have been eager to deploy into the sector. They see plenty of value-add opportunities and, fundamentally, the long-term projections for tourism numbers in Europe suggest that projected supply levels will be inadequate to satisfy this demand.”

The presence of international transport hubs is one of the biggest factors behind the appeal of cities for investors. The report identified a renewed focus from investors towards urban product, notably in Europe’s gateway cities, with 57% of respondents selecting central business districts as their preferred location. Resorts, a segment that has proven historically resilient to inflation, followed in second place at 36%. The continuation of a post-pandemic resurgence, the onward march of leisure demand and the scarcity of new supply suggest strong prospects for well-located resort properties.

“Italy,” explains Silvia Gandellini, Head of Capital Markets and Head of A&T High Street at CBRE Italy, “ranked as the second largest European market for investments in the Hotel sector in the first quarter of 2024, totalling €330 million. We expect this momentum to continue into the second half of the year, with potential signs of yield compression for new transactions involving trophy assets.”

In 2023, the most notable real estate transaction in Italy was the purchase of Hotel Six Senses in Rome’s historic Palazzo Salviati Cesi Mellini by Orion Capital Managers for €245 million following an initial investment of €95 million in 2018. Milan also saw a number of significant transactions, including the sale of NH Collection Milano CityLife by Igefi Group to Invesco Real Estate for €55 million, and that of Duomo Luxury Apartments by Rosa Grand, which was sold by Investire Sgr (via the Monviso fund) to Viking Bank for €49 million.