The construction market weakens in 2024

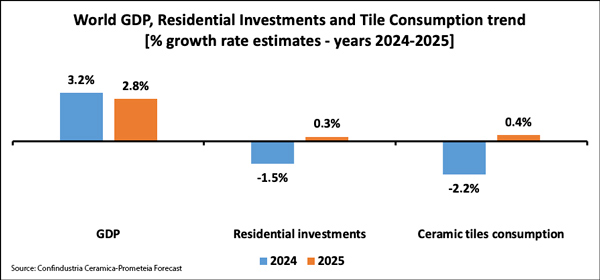

(December 2024) | 2024 is proving to be a year of slowing global economic growth due to heightened geopolitical tensions and ongoing inflationary pressures. Nonetheless, overall inflation is now approaching the targets set by central banks, which have introduced interest rate cuts that are expected to be maintained through 2025. According to the Prometeia-Confindustria Ceramica forecasting observatory, global economic growth is projected at +3.2% in 2024, with a more moderate pace anticipated for 2025-2026. Economic trends in 2024 are expected to vary across major regions. The United States is forecast to achieve GDP growth of +2.7%, while the euro area is likely to experience a more stagnant phase, with growth limited to +0.7%. In China, the ongoing real estate crisis is continuing to impact economic performance, with GDP growth projected to fall short of government targets at approximately +4.8%.

Against this backdrop, global investments in residential construction continue to show signs of weakness, with an estimated contraction of -1.5% compared to 2023. This decline reflects the ongoing negative investment cycle, particularly in advanced economies, which is expected to bottom out in 2024. In the United States, residential construction experienced strong growth early in the year but slowed in subsequent quarters, with significant declines in new construction and building permits. Despite this, growth of +3.8% is projected for 2024. The downturn in Western Europe is continuing, with Germany and France still recording residential investment below pre-pandemic levels. While the UK and Spain remain at the same levels as in 2019, Italy has reached significantly higher volumes, largely driven by incentives such as the Superbonus scheme. Overall, residential investment in Western Europe is expected to decrease by -3.5%, while a slight increase of +0.9% is projected in Eastern Europe. The picture is similarly mixed elsewhere in the world. China has reported a sharp decline in real estate investment, only partially offset by growth in infrastructure projects, while India is experiencing significant growth in investments. The Far East is expected to see a 4.3% decline compared to 2023. Investments in the Gulf countries are showing greater dynamism with 3.2% growth forecast for 2024, whereas residential construction investments in Latin America, North Africa and the Middle East are expected to decline.

The slowdown in construction has directly impacted the ceramic tile market, resulting in an anticipated global decline in consumption of -2.2%. In 2024, world demand is expected to stabilise at approximately 14.6 billion square metres, with the Asian continent continuing to contract (-3.7%) due to the sharp downturn in the Chinese market. In Western Europe, consumption is projected to decline slightly (-0.5%) while remaining very close to 2023 levels. Eastern Europe, on the other hand, is forecast to see a modest increase of about +1% compared to 2023. Tile consumption in the NAFTA region and Latin America is expected to remain relatively stable, while growth of +3.5% is forecast in the Gulf countries.

Looking ahead to 2025-2026, the global construction market is expected to experience a gradual recovery, with regional trends varying significantly. In advanced economies, the recovery will be slow and uneven. In the United States, residential construction is projected to continue expanding, albeit at a more moderate pace than in 2024. Within Europe, France and Germany are likely to remain in a downward cycle through 2025, followed by signs of recovery in 2026. 0Construction growth is expected to continue in Spain and gradually pick up in the United Kingdom, whereas Italy will see an inversion in the building cycle in 2025 as the robust growth in public works will be insufficient to offset the decline in residential construction. In Asia, the downturn in construction in China is expected to ease but is unlikely to stabilise entirely by the end of 2026. Conversely, residential investment in India and the Gulf countries is expected to remain dynamic. Positive prospects are also forecast for Brazil and South Africa, whereas Russia is likely to face substantial stagnation.

Globally, residential construction investments are expected to see modest growth in 2025 (+0.3%), with world ceramic tile consumption set to follow a similar upward trend (+0.4%). Construction investments are likely to see a stronger increase in 2026 (+1.8%). However, despite this widespread growth (except in Western Europe and the Far East), global construction levels by the end of the next two years are expected to remain below the peaks achieved in 2018-2019.

(Article reference photo: Michael Bader, Unsplash)