Market Economics

Logistics sector sees Europe-wide growth | by Giorgio Costa

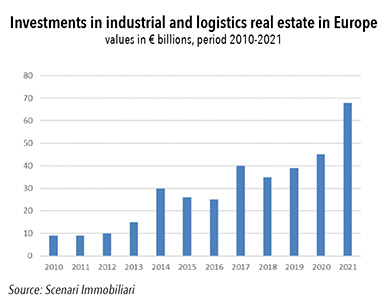

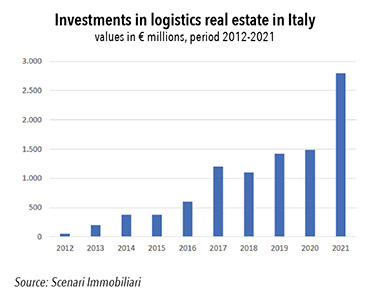

Logistics is an increasingly important sector of the Italian economy. According to figures contained in the Almanacco della Logistica 2022 published by the Confetra Research Centre, the industry consists of around 108,502 companies with a total of 996,939 employees, mostly operating in the fields of land freight transport and warehousing. And while logistics continues to grow in terms of business despite personnel shortages, investments in logistics real estate are also booming, reaching €68 billion in Europe in 2021 and accounting for more than 20% of all real estate investments (an increase of more than 50% compared to the previous year). These investments are also holding up well in the face of the international turbulence that has been destabilising the real estate and financial markets in recent months. The UK is the biggest European investor with around €19 billion of sales, followed by Germany with €10 billion (+25%) and France with over €6.5 billion. In Italy the logistics sector generated revenues of approximately €5.3 billion in 2021, a 7% increase with further 4% growth forecast for 2022. The lion’s share is held by the north of the country with 72% of investments, while central Italy trails far behind at 15% and the south and islands account for the remaining 13%. These figures emerge from the 2022 Report on the logistics real estate market in Europe and Italy published by Scenari Immobiliari in cooperation with SFRE, a project and construction management company specialising in logistics and light-industrial real estate.

In step with the steady expansion of the logistics market, the current real estate stock has grown to more than 44 million square metres following the completion of more than 1.6 million square metres of new developments in 2021 (6% more than in 2020). The estimates for 2022 point to developments of just over 1.7 million sqm.

“Logistics real estate is an asset class that is capable of maintaining positive and stable trends in the medium to long term and withstanding economic and political volatility,” explains Francesca Zirnstein, Managing Director of Scenari Immobiliari. “In Italy, this has translated into growing attention from domestic and international institutional investors, especially from the US and increasingly also from Southeast Asia. The surging demand in the logistics sector often exceeds the availability of space and is prompting growing interest in Grade A properties. At the same time, the emergence of new ways to buy services and products, particularly e-commerce, has fuelled demand for small-size last mile/last touch properties (from 5,000 to 15,000 square metres) which today have a potentially huge margin for growth, opening up potential for new investments in secondary locations.”

2021 marked a year of transition for logistics assets towards a sector with more stringent health standards (in response to the Covid-19 pandemic), intermodality and social, economic and environmental sustainability.

In step with the growth in investment values, rental prices are also increasing. Logistic property rents in Italy grew on average by more than 9% in 2021, with higher growth rates in Milan and the Lombardy region in general. During the same period, yields from logistics centres rose to a peak value of 6.50% in Italy, including figure of 4.3% in Milan and 5% in Rome.

November 2022