House prices expected to fall

The global real estate market has recorded an excellent performance in 2022, but the risk of a price bubble is just around the corner with Toronto, Frankfurt, Munich, Amsterdam, London, Miami and Los Angeles showing the most elevated imbalances, while values in Italy appear less unbalanced. The International Monetary Fund warns that the global real estate market is at a “tipping point” determined by rising interest rate in response to price pressures, which in turn have pushed up borrowing costs and house prices. A generalised severe slump in house prices is likely to be on the horizon. Data published by Oxford Economics are indicating a highly adverse scenario, with real house prices potentially falling by 25% over the next three years in developed countries and 10% in emerging economies. Moreover, while homeowners around the world are reckoning with increasingly unaffordable mortgage payments, prospective homebuyers are facing house prices that are rising faster than incomes. The European Central Bank calculates that, in a low interest rate environment, a one percentage point increase in mortgage rates corresponds roughly to a 9% drop in house prices and a 15% reduction in real estate investments after about two years. The slowdown in the real estate market is also likely to dampen overall economic activity, adversely affecting the construction industry and its suppliers. Claudio Saputelli, Head of Real Estate at UBS, says: “Inflation and asset losses due to turmoil in the financial markets are reducing household purchasing power, which curbs demand for additional living space. Housing is thus also becoming less attractive as an investment, as borrowing costs in many cities exceed the yields of buy-to-let investments.”

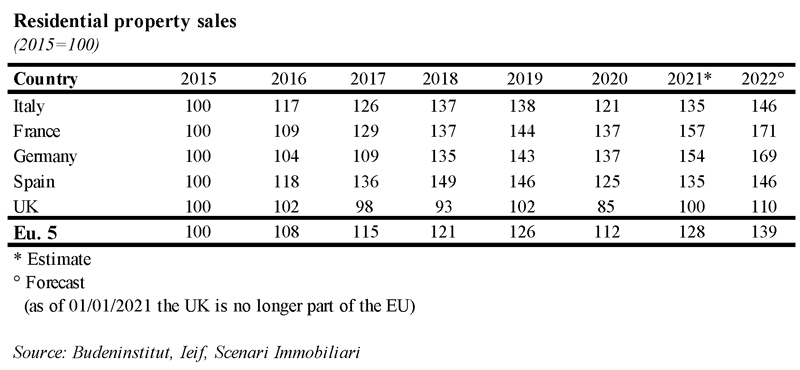

In the meantime, the European real estate market has recorded an almost 10% increase in turnover in 2022 compared to 2021. It has likewise been a very good year for the Italian market with a turnover of €140 billion (+9.9%). Between June 2021 and June 2022, the total investment volume in Europe reached a record figure of €387.3 billion, 35% higher than in the same period in 2020-2021. These figures emerge from the European Outlook 2023 published by Scenari Immobiliari. “The market is going through a delicate phase, amid an economic scenario that is facing a perfect storm of war, inflation, post-pandemic hurdles and political crises that will realistically continue into 2023,” explains Mario Breglia, chairman of Scenari Immobiliari. “After two particularly good years, real estate companies are now highly structured and have considerable financial capacity, and demand is still robust because it is based on product innovation rather than being speculative in nature. However, external conditions are negative and are pulling the market in a different direction.”

As a result, there is a very real risk of a price bubble. According to the UBS Global Real Estate Bubble Index 2022, an annual study conducted by UBS Global Wealth’s Chief Investment Office, imbalances in global metropolitan housing markets are highly elevated and prices are out of sync with rising interest rates. Toronto and Frankfurt top this year’s index, with both markets exhibiting pronounced bubble characteristics. Risks are also elevated in Zurich, Munich, Hong Kong, Vancouver, Amsterdam, Tel Aviv and Tokyo. In the US, all five analysed cities are in overvalued territory with the imbalance more pronounced in Miami and Los Angeles than in San Francisco, Boston and New York. Housing market imbalances remain high in Stockholm, Paris, and Sydney despite some cooling. Other housing markets with signs of overvaluation include Geneva, London, Madrid and Singapore. São Paulo is fair-valued alongside Milan and Warsaw, and despite a buoyant year Dubai’s housing market is also in fair-valued territory. According to the UBS study, all but three cities – Paris, Hong Kong and Stockholm – saw their house prices climb. On top of this, an acceleration in the growth of outstanding mortgages was evident in virtually all cities, and for the second year in a row, household debt grew significantly faster than the long-term average.

January 2023