Market Economics

Global markets offer strong investment opportunities | by Giorgio Costa

The global real estate market still offers plenty of investment opportunities but is increasingly seeing targets chosen according to connectivity and sustainability, a trend fuelled in part by the awareness that real estate is responsible for around 40% of global carbon dioxide emissions. Smart buildings in particular can make a vital contribution to the change of direction that is now urgently needed. Research for Markets estimates that the value of the global smart buildings market will grow from almost US $8.5 billion (2016) to US $57.8 billion by 2023, corresponding to a compound annual growth rate of 31.5%. However, according to the Nuveen Real Estate report, the pandemic has not caused the real estate sector to change course but has merely accelerated existing trends. And despite the lockdowns, the major European markets have continued to attract investment. Far from being in decline, the housing market appears to have emerged almost unscathed from the crisis unleashed by the Covid-19 pandemic.

Property investment as an opportunity

The emerging signals of economic recovery make real estate investment a good opportunity. In particular, the Nuveen Real Estate report found that over a 12-month period:

– lenders are continuing to show forbearance towards borrowers in the real estate sector in the belief that the effects of the pandemic are temporary;

– domestic markets are responding well, while international capital flows are less agile due to travel restrictions;

– the expected rise in inflation and soaring long-term yields indicate an improvement in growth prospects and will boost interest in investment.

Moreover, according to Nuveen, the share of enforced savings triggered by the pandemic restrictions will create a rebound effect in the consumer sector, driving demand for housing, e-commerce and services. According to the Nuveen Real Estate Outlook, three major trends will bring about a permanent change in the real estate sector:

– the growth in alternative real estate: as investment opportunities evolve over the next decade, the flow of investments from institutional investors into alternative assets will increase from 10-12% to over 50%;

– the impact of ESG (Environmental, Social and Governance) factors in the real estate sector: the transition towards carbon-neutral real estate is already underway and European and American emissions regulations are spurring greater attention to the social value of real estate. Over time, this will open up opportunities for the redevelopment of underused types of properties in order to offer more attractive buildings to local communities;

– increasingly flexible working: one of the most significant societal transformations brought about by the pandemic is the change in approach to office work. Never before have companies been so strongly focused on the concepts of home working and flexibility. This is driving a surge in demand for smart buildings capable of supporting hybrid working models and office buildings that can have a positive influence on personal well-being.

The economic climate in European markets

The Nuveen Outlook notes that the major European markets have continued to attract investment despite the lockdowns. Domestic markets (such as Germany, Sweden and France) have reacted better than international markets (such as Poland and the UK). The support of governments, the accommodative policy of the Central Bank and the forbearance of lenders have been crucial factors in easing the pressure on real estate investors in the struggling retail and hotel sectors. The logistics sector is flourishing, with rental and sales prices expected to rise throughout the year, and prop-tech (real estate management innovation) is also gaining momentum. As for the retail sector, a distinction must be drawn between large and small/medium-sized retailers. Shopping centres continue to struggle due to enforced closures during lockdowns, while supermarkets are benefiting from extended opening hours, restaurant closures and the fact that people are eating at home.

Monaco gains superstar status

Meanwhile, Monaco retains its unique status in terms of exclusivity. One of the world’s smallest states, it also boasts the highest average prices per square metre for the purchase and rental of prime real estate. A report by Savills reveals that real estate in the Principality is more expensive than in Hong Kong or New York. According to the Savills World Cities Index 2020, Monaco remains the most expensive place in the world for residential property with an average price per square metre in excess of 48,000 euros.

Competition between rental and ownership

The impact of the pandemic on housing markets varies from one market to another and between the rental and property sectors, as the recent Cushman and Wakefield report shows. Rents have fallen in 18 out of the 27 markets included in the global survey whereas property prices have risen in 22 out of the 27 markets, suggesting that residents have confidence in these global urban centres. Property owners have largely overestimated rental prices because the pandemic has hit renters harder than homeowners and those with the means to purchase houses. Housing sales have accelerated and have been brought forward due to the pandemic, suggesting that sales may fall in the post-pandemic period, particularly given the surge in prices. Rents and sales prices have both increased during the pandemic. Although growth rates in some of these markets slowed in 2020, the overall growth points to continued strong demand for housing in Paris, Amsterdam, Berlin, Atlanta, Stockholm and Shanghai. The rental market has only grown in Shenzhen and Mexico City. Two factors go a long way to explaining Shenzhen’s popularity as a luxury rental location. Firstly, the market started out from a lower base than markets such as Shanghai. Secondly, the market is rewarding China’s leading technology hub. By contrast, the fact that Madrid and Milan suffered some of the worst Covid-19 outbreaks in 2020 helps explain their poor performance compared to other regional markets. However, most global gateway markets saw rising house prices and falling rents in 2020, suggesting that residents are reaffirming their commitment to these markets by purchasing homes rather than moving away. Rents have fallen in general as the benefits of urban living have declined during the pandemic, resulting in reduced inflows. At the same time, house prices have risen as affluent renters make the transition to home ownership, often in search of more space. Rising house prices are therefore a sign of confidence in the long-term economic prospects of these markets, which in turn will attract renewed demand from post-pandemic renters.

The dynamics of European markets

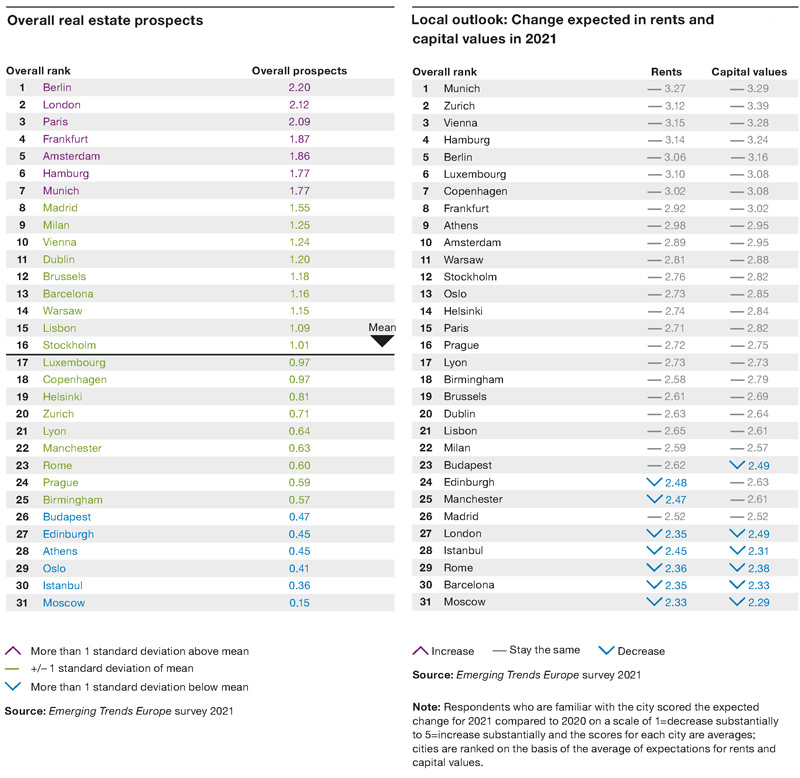

In a PWC survey of European market prospects, Berlin has climbed one position to reclaim the top spot and oust Paris, which in turn has fallen to third place just behind London. The German capital is much in demand for its office space and potential rent increases. Germany’s other three main markets remain firmly in the top 10, with Frankfurt, Hamburg and Munich in fourth, sixth and seventh positions respectively. Moreover, Germany is in better shape than most other economies, making the country popular for investments. London takes silver this year, up two places ahead of Paris, and is seen by many investors as a resilient prospect in the medium to long term, although the hard Brexit agreement may harm the market over the next couple of years. For investors not present in London, falling prices may provide an opportunity to build a high-quality portfolio. The Covid-19 pandemic has not been a “good crisis” for the large capital cities. In London and Paris, for example, public transport plays a disproportionately large role and it is harder to get to work on foot, by bicycle or even by car than in smaller competing cities. And in reality people have returned to working in offices much more in Frankfurt than in London. This circumstance could favour smaller cities after decades spent in the shadow of their larger counterparts, provided they are well connected in terms of transport. In a world of more home working, even if one’s employer is based in Munich, for example, one could choose to live in Ingolstadt or Regensburg, beautiful cities an hour and a half away by train and just go to the office two or three days a week. It is also noteworthy that digital connectivity is more highly rated this year (with 43% of respondents saying it is very important against 32% last year). This also applies to residential and logistics. In addition, the outlook for southern European cities has worsened given the sheer scale of the current economic challenges. With Spain and Portugal heavily reliant on tourism, Madrid, Barcelona and Lisbon have all moved down in the rankings, to numbers 8, 13, and 15, respectively. Madrid has slipped down three places but still remains popular. Italy’s two main markets, Rome and Milan, are viewed very differently. At number 23, Rome’s prospects are lowly ranked, although many investors believe Rome is the new city to invest in as it has reached the bottom of the economic and social cycle. Milan, on the other hand, is increasingly treated as a “northern” city and at number 9 sits just above Vienna. Yields for its best offices are level with parts of Germany and it is a prime target for logistics operators. In Dublin, ranked 11th, demand for private rental residential and student housing remains extremely strong. However, there is concern about Dublin’s office market as new stock becomes available. Warsaw (14), Luxembourg (17) and Zurich (20) stand roughly midtable, although some observers believe that prices in Warsaw will need to fall to make the city attractive to potential investors. In reality, investors in search of a safe haven are opting for medium-large cities and capitals, such as London, Paris, Amsterdam, Milan, Munich and Frankfurt.

In a PWC survey of European market prospects, Berlin has climbed one position to reclaim the top spot and oust Paris, which in turn has fallen to third place just behind London. The German capital is much in demand for its office space and potential rent increases. Germany’s other three main markets remain firmly in the top 10, with Frankfurt, Hamburg and Munich in fourth, sixth and seventh positions respectively. Moreover, Germany is in better shape than most other economies, making the country popular for investments. London takes silver this year, up two places ahead of Paris, and is seen by many investors as a resilient prospect in the medium to long term, although the hard Brexit agreement may harm the market over the next couple of years. For investors not present in London, falling prices may provide an opportunity to build a high-quality portfolio. The Covid-19 pandemic has not been a “good crisis” for the large capital cities. In London and Paris, for example, public transport plays a disproportionately large role and it is harder to get to work on foot, by bicycle or even by car than in smaller competing cities. And in reality people have returned to working in offices much more in Frankfurt than in London. This circumstance could favour smaller cities after decades spent in the shadow of their larger counterparts, provided they are well connected in terms of transport. In a world of more home working, even if one’s employer is based in Munich, for example, one could choose to live in Ingolstadt or Regensburg, beautiful cities an hour and a half away by train and just go to the office two or three days a week. It is also noteworthy that digital connectivity is more highly rated this year (with 43% of respondents saying it is very important against 32% last year). This also applies to residential and logistics. In addition, the outlook for southern European cities has worsened given the sheer scale of the current economic challenges. With Spain and Portugal heavily reliant on tourism, Madrid, Barcelona and Lisbon have all moved down in the rankings, to numbers 8, 13, and 15, respectively. Madrid has slipped down three places but still remains popular. Italy’s two main markets, Rome and Milan, are viewed very differently. At number 23, Rome’s prospects are lowly ranked, although many investors believe Rome is the new city to invest in as it has reached the bottom of the economic and social cycle. Milan, on the other hand, is increasingly treated as a “northern” city and at number 9 sits just above Vienna. Yields for its best offices are level with parts of Germany and it is a prime target for logistics operators. In Dublin, ranked 11th, demand for private rental residential and student housing remains extremely strong. However, there is concern about Dublin’s office market as new stock becomes available. Warsaw (14), Luxembourg (17) and Zurich (20) stand roughly midtable, although some observers believe that prices in Warsaw will need to fall to make the city attractive to potential investors. In reality, investors in search of a safe haven are opting for medium-large cities and capitals, such as London, Paris, Amsterdam, Milan, Munich and Frankfurt.

The retail property market

According to Scenari Immobiliari, the European retail property market has been severely hit by the pandemic. Store and retail chain closures, coupled with a small number of openings, led to a 31.1% decline in 2020 to a total of around 29 billion euros. A 20.7% increase to 35 billion euros is estimated for 2021, although this remains the lowest value of the century. The decline in commercial real estate investment has been driven not only by the onset of the pandemic in 2020 but also by the steady growth of online sales. Increasing investor caution, leading to a gradual reduction in the share of commercial property in large portfolios to around 16%, has been compounded by the effects of the lockdown, with profitability impacted by tenants struggling to pay rent due to lost earnings.

July 2021