Commercial real estate resumes growth in Europe

Amid soaring inflation and geopolitical tensions, the real estate industry (especially the commercial segment) is looking nervously ahead to the rest of 2023, a year when prices are expected to fall and real yields will be highly dependent on the rate of inflation. “It is clear that 2023 will present challenges for real estate investors. However, this time of high market stress will present opportunities to those investors with the requisite market knowledge,” comments Kiran Patel, Global CIO and Deputy Global CEO at Savills. “The strong structural trends associated with urbanisation benefit both convenience retailing and last mile logistics, and we have a positive outlook for specialised residential (elderly and student housing) as well as multifamily rental,” he continues. But while real estate outperformed most sectors globally in 2022, the outlook for 2023 is not quite as rosy due to rising inflation and geopolitical tensions in Europe. This is the conclusion of Nuveen’s Real Estate Outlook 2023, which is forecasting downturns and value losses across a number of markets and sectors. But according to the US asset manager, opportunities will remain in commercial real estate even as the market slows. According to Colliers’ Global Real Estate Insights commercial real estate markets will witness a significant pricing correction in the face of continued interest rate hikes. The journey to more sustainable pricing will differ markedly across locations due to the speed and extent to which interest rates are changing, but a 15% average correction in capital values is expected. By the end of 2023 we should see investment activity bottom out and recover, partly due to the fact that the Yen has reached historic lows.

The situation in Europe

The total volume of commercial real estate investments (retail, office and industrial) in Europe reached €283 billion at the end of September 2022.

The retail sector recorded the highest growth (+23%), followed by logistics (+12%) and offices (+10%). In 2022, the UK, Germany and France continued to attract the largest numbers of investors with investment volumes of €66 billion, €63 billion and €34 billion, respectively. While remaining predominantly invested in office space, the market is tending to shift towards other asset classes against a backdrop of hyper-selectivity on the part of investors, in other words buyers are focused on a few well-established markets. The major European cities experienced an increase in demand, led by Dublin, London and Munich with growth of 178%, 83% and 56%, respectively. By contrast, Amsterdam saw an 8% year-on-year drop in demand. Demand for office space in Europe rebounded strongly last year after Covid, helping the market to charge higher rents and thus partly offsetting the price correction caused by rising interest rates. In 2022, 12.6 million sqm of office space was rented across Europe, 15% more than the previous year when many employees were working from home due to the pandemic. This is revealed by data from the consultancy firm Cushman & Wakefield, which also reports that rents increased by 6.2% in the final quarter compared to the previous year, the strongest annualised rate increase since mid-2008.

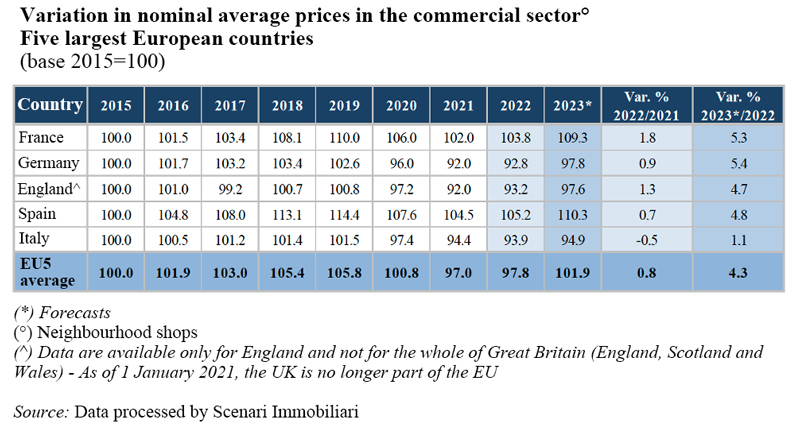

In 2022 prices appear to have finally reversed the negative trend seen during 2020-2021. According to the 2023 Report on the commercial real estate market published by Scenari Immobiliari, sales prices and rents in the main EU countries have risen by an average of close to 1%, with a further rise of more than 4% expected this year. This growth is mainly attributable to the return of shopping centre footfalls to pre-pandemic levels, a number of tourist arrivals that is rapidly approaching and, in some cases, exceeding the levels recorded during 2019 in the continent’s major cities, and a process of realignment between purchases online and at physical stores.

European markets are moving at two different speeds, with central locations seeing high demand and low supply and peripheral locations experiencing declining demand. Prime rents have increased year on year in all central locations of major European cities. For example, London, Brussels, Berlin, Amsterdam and Milan recorded further increases in rental values in Q3 2022. However, the gap continues to widen between centrally located and suburban buildings, which face further downward pressure on rents.

Asia and the United States

Offices are likely to be the dominant asset class, with 60% of investments in Shenzhen, Beijing, Guangzhou and Seoul expected to be concentrated in this sector. The next favourite asset classes are logistics and residential, with North American investors in particular expected to favour residential. In 2022, it is estimated that 47% of all US investments came from international investors (with just under half from neighbouring countries) and 53% from domestic capital. According to Savills, sustainability is becoming an increasingly important part of investors’ strategies. However, researchers in Hong Kong, Tokyo, Jakarta and Seoul said that it is not yet deemed important by buyers but that this is likely to change soon given the global focus on the ESG agenda. 46% of researchers pointed to the opportunity to increase returns as a significant ESG motivator. Given the Federal Reserve’s policy of tightening financial conditions to curb inflation, Franklin Templeton believes that 2023 will be a difficult year for the US market amid high interest rates and risk of a recession. However, there are also a number of positive elements. National consumer spending, labour markets, corporate activity, corporate balance sheets and the banking system all remained relatively healthy, and historically the US commercial real estate investment performance has reacted well in periods of rising interest rates.

March 2023