Emerging trends in the European kitchen furniture market

(November 2024) | Kitchen furniture production in Europe is worth around EUR 19 billion. The sector is going through a general phase of adjustment after the two-year boom that followed the pandemic. Business output is tending to return to more subdued levels, aided by still high inflation and the resulting slowdown in the European economy.

The upper-end market segment (including altogether mid-upper, upper and luxury) held up better in the last five years, while the middle and mid-low market slowed, and low/entry level units decreased more significantly.

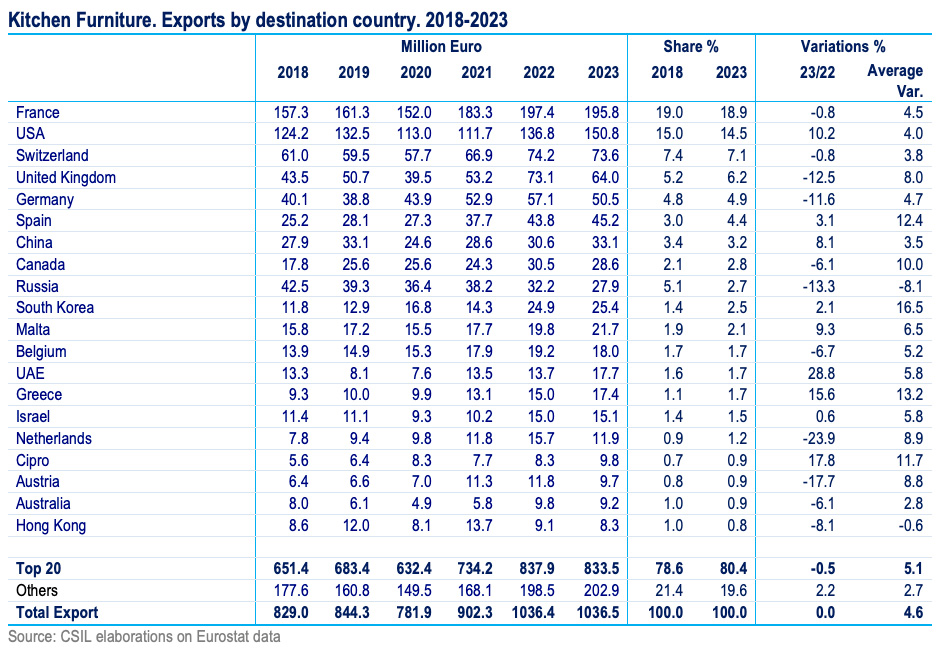

The openness to the international trade has evolved positively over the last years. The incidence of exports on production reached about 26% in 2023, while the weight of imports on consumption is worth about 20%. It should be pointed out, that about 80% of the exports remain inside the European perimeter, while the remaining 20% is destined overseas. Almost 40% of the overseas export goes to North America (upward trend), more of 30% to Asia and Pacific, 14% goes to Middle East area. Considering a mid-time perspective, exports of kitchen furniture in Europe was growing with an average of 5% since 2018.

Sustainability and connectivity: the main emerging trends

The European kitchen furniture market is undergoing significant changes and innovations, driven by global trends focusing on emerging technologies that are transforming the sector. With a growing demand for customization and sustainable solutions, manufacturers are adopting new technologies and innovative materials to meet the needs of the emerging market demand. One of the main trends in the kitchen furniture sector is the adoption of sustainable materials. Consumers are increasingly aware of the environmental impact of the products they purchase, and manufacturers expanded portfolio with natural materials, recycled materials, green products and low-impact finishes (e.g. non-toxic, water-based eco-paints). Innovation in materials will continue to be a key factor. Manufacturers will explore new eco-friendly solutions, such as bio composites and regenerative materials, that offer high performance with a reduced environmental impact. These innovations will not only improve the sustainability of products but also their durability and resistance.

The integration of technology into the kitchen furniture is another significant trend. Manufacturers are incorporating LED lighting systems, smart appliances, and home automation solutions to enhance the user experience. Digitalization not only facilitates the daily use of the kitchen but also allows for greater energy efficiency and optimized resource management. In the near future further integration of smart technology into kitchen furniture is expected. Advances in artificial intelligence and the Internet of Things (IoT) will enable the creation of increasingly smart and interconnected kitchens. For example, smart refrigerators will be able to monitor and manage food stocks, while intelligent ovens will offer personalized recipes and optimized cooking.

Industry organization

From an industrial point of view, the last few years have seen an increase in the concentration of production in Europe. Today the top five kitchen furniture players account for 35% of the entire output of the sector and the top twenty companies hold a cumulative share of about 65% of the total European production, and this share increased significantly if compared to a few years ago.

A significant transformation factor affecting the kitchen furniture sector in recent years is certainly the reorganization of production capacity in Europe. As a result of the mergers and acquisitions in the sector the number of production plants has probably shrunk in favour of an extensive renovation of larger and technologically advanced factories. The level of investment in innovation and machinery has certainly increased along with the resources dedicated to renewable energy and sustainability.

Relevant industry facts of 2024

– O2 Capital Partners acquired Bribus, which was previously owned by Swedish kitchen furniture manufacturer Nobia

– Nobia sold its Austrian subsidiary of kitchen furniture production, Ewe Kuchen, which is now independently owned

– Woodland Kitchens, Northern Irish manufacturer and supplier of kitchen, bedroom, and bathroom furniture acquired Scottish manufacturer and supplier of fitted furniture, JTC, which focuses on social housing and student accommodation markets. The partnership will create one of the largest cabinet producers in the UK

– Nolte UK has acquired the British contracts kitchen installation business BKNC

– The German Nobilia formally acquired shares in Ecocuisine, a kitchen distribution network with 110 stores in France

– The KBV Group, which integrates OB Cocinas and Delta, acquired Doca Cocinas.

‘The European market for kitchen furniture’ CSIL Report

The CSIL Report ‘The European market for kitchen furniture’ provides an overview of the kitchen furniture sector through tables and graphs, data on production, consumption, and international trade at the European level and for 30 countries. The analysis is given both in value and in volume, for the total sector and by price range. A panorama of the leading European groups and their market shares is provided. The competition and the distribution analysis are also pro-vided at single country level. The European market for kitchen furniture’ is available for online: World Furniture online.